A younger friend recently accepted a new and well-paying job (congrats again, D!). Upon my advice to pay yourself first, he challenged back with alternative ponderings such as “If I retire…” and “Realistically I think I’d do a semi-retirement.” These are valid and convenient perspectives shared by many.

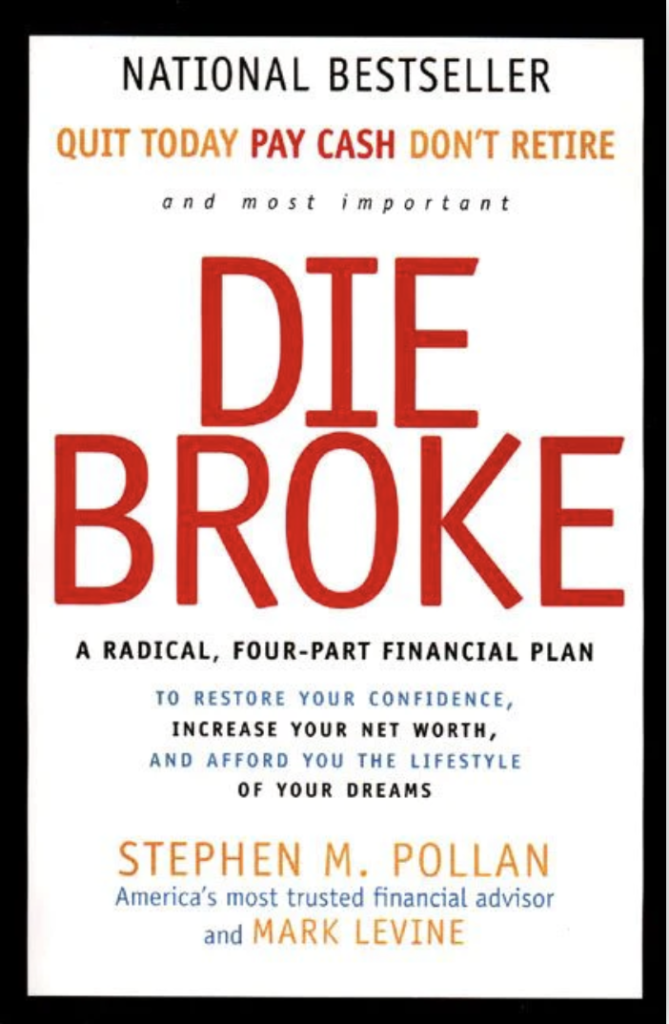

In his bestselling book Die Broke, Stephen Pollan suggests that we “Don’t Retire”. I could explain the reasons for this advice, but you really should read the book. (Go get it now).

Despite this Don’t Retire perspective, I advise against making a financial plan which depends on this…particularly for those of us (myself not included) who are young and early in our careers.

There are many, many reasons to go ahead and sock money away despite our intentions to continue working into our golden years. Here are just a few:

Retirement fund are not just for retirement. Understand that retirement savings accounts are assets that you own and which can contribute substantially to your net worth. I’m not suggesting that retirement accounts should be plundered for reasons other than retirement, rather that they provide a nest egg and safety net.

You may not be able to continue working. While we all hope to remain gainfully employed and productive late into life, this is not ultimately in our control. Unexpected layoffs, economic downturns, health and disability issues, or interfering family priorities are just a few of the curveballs life may throw our way and thwart any plan to keep working and earning.

Retirement funds provide freedom well in advance of retirement. Of course having funds in place for retirement provides you the option to retire when the time comes. But what many don’t realize is that having those funds in place also provides more freedom in your working years. The more you can sock away, the less you will need to save later. And the less you need to save…the less you need to earn and work in order to do so.

Consider that saving NOW for retirement may allow you to ease into semi-retirement earlier than you otherwise could.

Don’t retire? That’s a great plan…just don’t rely on it.