Q: Do I need a budget?

A: No, you really DON’T.

Why do people budget?

We know we should save money. Savings are necessary to fall back on in case of an emergency. Wealth is required so that we can eventually stop working (whether we choose to or not) and still live comfortably. Living a comfortable lifestyle now is certainly important, but without building wealth you are at risk of not affording and sustaining your level of living in later years. With enough wealth, you no longer need to work but instead can choose to and on your own terms.

Maybe money can’t buy happiness, but it certainly buys freedom.

Savings is traditionally defined as “the amount that is left after spending.” But for most people, there is no amount left after spending, therefore nothing leftover to save. Many people report feeling out of control with their finances, unaware of where their money goes each month and frustrated that they never seem to be able to save and get ahead. They don’t know how to balance later priorities (savings) with what feels important right now (spending).

How are we supposed to limit spending so that something is left to save in the end?

The old answer: Budgets

The new answer: Buck that.

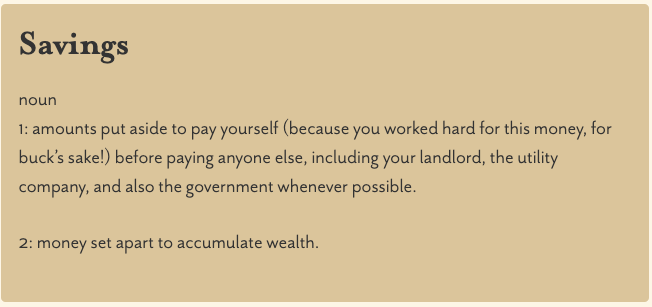

Let’s start by redefining savings:

With this new and improved definition, savings is now undeniably our first and highest priority.

Spending now falls back as the second priority AND you get to spend everything that remains since you’ve already done the great thing of saving first. Just spend what’s left and no more than that. Simple and realistic, finally!

Thank you, budgets (for nothing anyway), but your services are no longer needed.

Bye-bye, budgets! We’re on to something better.

Are you ready to stop budgeting? Then, let’s Buck the Budget together. Join me by becoming part of our community to realistically, effectively, and finally get ahead. It’s easy, just sign up here: buckthebudget.com.